What is Due Diligence in Banking?

Due diligence is pivotal to ensuring the integrity and security of every financial institution. With increasing regulatory requirements and evolving financial crimes, banks must adopt robust due diligence practices to protect themselves, their customers, and the broader financial system.

Customer Due Diligence

Customer Due Diligence (CDD) is a foundational element of modern banking compliance, aimed at verifying customer identities, understanding their financial behavior, and assessing risk. In 2016, the Financial Crimes Enforcement Network (FinCEN) introduced the CDD Final Rule, which formalized longstanding supervisory expectations into a clear regulatory framework for financial institutions.

The rule requires banks to collect and verify specific information about their customers, including identifying the beneficial owners of legal entity accounts. It emphasizes that due diligence must be an ongoing process, not a one-time step, reinforcing the need for regular monitoring and updates. Importantly, the rule does not reduce or limit existing regulatory obligations; instead, it strengthens them by clarifying the standards expected across the industry. As financial crime threats evolve, the CDD rule ensures institutions remain proactive and accountable in protecting the financial system.

Regulatory Requirements

All banks are legally obligated to implement risk-based procedures for ongoing customer due diligence (CDD), as mandated by various national and international frameworks. These procedures form a key part of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) compliance strategies.

Know Your Customer (KYC): At the core of CDD is the Know Your Customer process, which includes Customer Identity Verification (IDV). This step ensures that financial institutions can accurately verify the identity of individuals and businesses using reliable, independent sources. IDV involves collecting personal or corporate identifying information—such as names, addresses, and government-issued IDs—and validating their authenticity. KYC is a legal requirement under regulations such as the USA PATRIOT Act Section 326 in the United States and the EU’s 6th Anti-Money Laundering Directive (6AMLD).

Ongoing Monitoring: Compliance does not end at onboarding. Financial institutions must continuously monitor customer transactions to detect suspicious activity, ensure data remains up to date, and reassess customer risk profiles. This includes regularly verifying and updating information on the beneficial owners of legal entity customers. These obligations are reinforced by rules such as the FinCEN Customer Due Diligence Final Rule (31 CFR 1010.230) in the U.S., which sets specific expectations for maintaining accurate and timely customer information throughout the relationship.

Together, these regulatory requirements ensure that banks are not only identifying their customers correctly but also monitoring for emerging risks over time. Institutions that fail to comply risk significant penalties, reputational damage, and exposure to criminal exploitation.

Types of Due Diligence (CDD, SDD, EDD)

Due diligence in banking is not a one-size-fits-all process. Depending on the level of risk a customer presents, financial institutions apply different tiers of due diligence: Customer Due Diligence (CDD), Simplified Due Diligence (SDD), and Enhanced Due Diligence (EDD).

Customer Due Diligence (CDD) is the standard level applied to most customers. It involves verifying identity, understanding the nature of the business relationship, and conducting ongoing monitoring. CDD forms the baseline of a bank’s AML compliance program and is required under regulations like the FinCEN CDD Rule.

Simplified Due Diligence (SDD) may be applied when the risk of money laundering or terrorist financing is considered low—such as for low-value accounts or regulated entities with transparent ownership structures. While SDD allows for reduced documentation and checks, it must still meet regulatory standards and be justified by a documented risk assessment.

Enhanced Due Diligence (EDD) is used for high-risk customers, including politically exposed persons (PEPs), entities in high-risk jurisdictions, or clients with complex ownership structures. EDD involves deeper scrutiny, additional documentation, and closer transaction monitoring. It is essential for identifying hidden risks and fulfilling obligations under regulations like the EU’s 6AMLD and FATF Recommendations.

Choosing the right level of due diligence is critical to managing compliance efficiently while aligning with the bank’s overall risk appetite. A well-calibrated due diligence framework ensures resources are focused where they matter most.

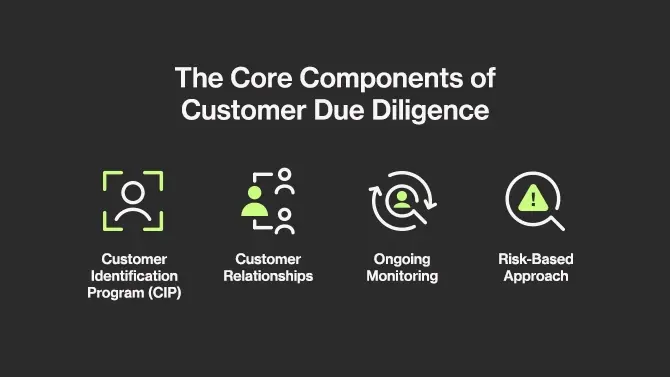

The Core Components of Customer Due Diligence

Effective Customer Due Diligence (CDD) relies on four core elements that work together to assess, monitor, and manage customer risk throughout the business relationship:

Customer Identification Program (CIP):

The first step in CDD is confirming a customer’s identity by collecting key details such as full name, address, date of birth, and identification number. This data must be verified using trustworthy sources and robust Identity Verification (IDV) systems to ensure authenticity.

Understanding the Nature and Purpose of Customer Relationships:

Banks must gather enough information to understand why the customer is opening an account and how they intend to use it. This insight helps define the customer’s risk level and determine the appropriate level of oversight.

Ongoing Monitoring and Information Updates:

Continuous transaction monitoring allows banks to detect unusual behavior or suspicious activity in real time. Institutions must also keep customer records current—especially information related to beneficial ownership—through periodic reviews and updates.Risk-Based Approach:

Not all customers carry the same level of risk. A risk-based approach ensures that higher-risk customers receive more detailed scrutiny and ongoing attention, while lower-risk clients can be monitored more efficiently. This allows banks to allocate resources effectively while maintaining compliance.

Identifying High-Risk Customers

High-risk customers pose a greater threat of involvement in financial crimes such as money laundering, terrorist financing, and fraud. Identifying these individuals or entities early allows financial institutions to apply Enhanced Due Diligence (EDD) and take proactive steps to manage associated risks.

Several factors may indicate a customer is high-risk:

Sanctions Lists: Customers appearing on national or international sanctions lists are automatically flagged. Sanctions screening ensures that institutions do not inadvertently do business with individuals, companies, or countries subject to trade or financial restrictions.

Politically Exposed Persons (PEPs): PEPs are individuals who currently hold or have previously held prominent public functions—such as heads of state, senior politicians, high-ranking military officers, or judges. Due to their position and influence, people with PEP status are considered more vulnerable to bribery, corruption, and abuse of power.

Adverse Media Screening: Negative news or reputational risk media related to a customer can signal previous or ongoing involvement in criminal activity. This includes coverage of fraud, litigation, regulatory violations, or financial misconduct, even if no formal charges have been filed.

High-Risk Jurisdictions: Customers operating in or affiliated with countries known for weak AML controls, corruption, or political instability may require additional scrutiny under global risk frameworks like FATF’s high-risk and monitored jurisdictions list.

Complex Ownership Structures: Legal entities with opaque or layered ownership can be used to hide beneficial owners and conceal illicit activity. These structures often necessitate deeper investigation to uncover the true source of funds.

By identifying these risk factors, banks can tailor their compliance efforts, enhance their monitoring, and reduce the likelihood of regulatory breaches or reputational harm.

Challenges in Implementing Due Diligence

Implementing effective due diligence processes is essential but comes with several challenges that financial institutions must navigate. One of the most pressing is the constantly evolving regulatory landscape, which demands ongoing attention, resources, and specialized expertise to stay compliant. Banks must also manage large volumes of customer data (collecting, verifying, and continuously updating information) in a secure and efficient way. This requires investment in advanced technology and strong data governance practices. At the same time, institutions must strike a careful balance between thorough compliance and a smooth, user-friendly customer experience, avoiding friction that could deter legitimate clients. Despite these hurdles, with the right systems, risk frameworks, and training in place, banks can overcome these obstacles and maintain robust, scalable due diligence procedures.

The Benefits of Effective Due Diligence

Compliance with Regulations:

Adhering to due diligence requirements ensures financial institutions remain compliant with national and international laws. This reduces the risk of regulatory penalties, legal disputes, and reputational damage, all while demonstrating a commitment to ethical and lawful operations.

Prevention of Financial Crimes:

Thorough due diligence is key to detecting and preventing money laundering, fraud, terrorist financing, and other illicit activities. By identifying risks early, banks can take timely action and prevent financial systems from being exploited. Tools like Ondato’s automated risk checks enhance this process by flagging suspicious profiles in real time.

Protection of Reputation:

Implementing strong due diligence safeguards a bank’s reputation by ensuring high standards of transparency and accountability. Customers, regulators, and partners are more likely to trust institutions that demonstrate rigorous compliance and proactive risk management.

Enhanced Decision Making:

With a complete and up-to-date understanding of customer profiles, banks can make more informed decisions about risk exposure, product suitability, and relationship management. Ondato’s platform supports this by centralizing and streamlining identity and risk data, making it easier for institutions to act with confidence and clarity.

Last Thoughts

Due diligence is essential for banking operations and maintaining the integrity and security of financial systems. By implementing comprehensive and risk-based due diligence procedures, banks can comply with regulations, prevent financial crimes, and build a trustworthy reputation. Comprehensive due diligence measures allow banks to stay vigilant, leveraging technology and expertise to enhance their due diligence practices. In doing so, they not only safeguard their interests but also contribute to the stability and trustworthiness of the global financial system.